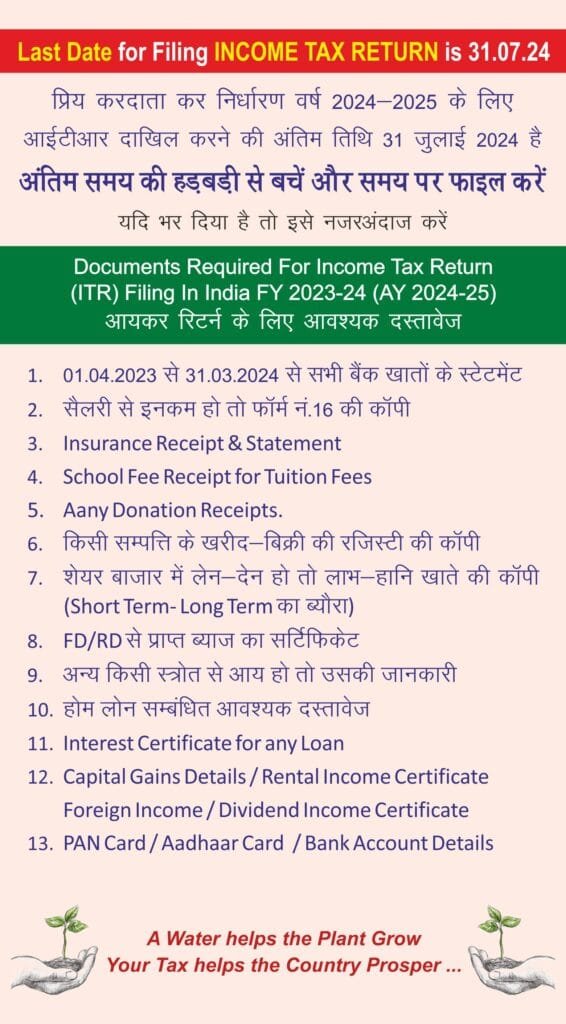

वित्त वर्ष 23-24 की आईटीआर फाइलिंग की अंतिम तिथि

Documents are Required to File Income Tax in INDIA

Financial Year 2023-2024

Assessment Year 2024-2025)

ITR Filing Last Date of FY 23-24

The last date for filing Income Tax Returns (ITR) for the financial year 2023-2024 hasn’t been announced yet. Typically, it falls around July 31st of the assessment year, but it’s always best to keep an eye on official announcements from the Income Tax Department for any updates or changes.

- Statement of all bank accounts from 01.04.2023 to 31.03.2024.

- If there is income from salary, then copy of Form No. 16.

- Insurance Receipt & Statement.

- School Fee Receipt for Tuition Fees.

- Any Donation Receipts.

- Copy of the register of purchase and sale of any property.

- If there is a transaction in the stock market, then copy of the profit and loss account (details of Short Term- Long Term).

- Certificate of interest received from ITR.

- If there is income from any other source, then its information.

- Necessary documents related to home loan.

- Interest Certificate for any Loan.

- Capital Gains Details / Rental Income Certificate Foreign Income / Dividend Income Certificate.

- PAN Card / Aadhaar Card / Bank Account Details.

https://architaccurate.com/1241/

ITR Filing Last Date of FY 23-24

“Don’t Miss Out! Your Ultimate Guide to ITR Filing: Last Date FY 23-24 Revealed”

“Beat the Clock: Top Strategies for ITR Filing Before FY 23-24 Deadline”

“Stay Ahead of the Curve: Expert Tips for Smooth ITR Filing by FY 23-24 Deadline”

“Unlocking Secrets: Maximize Returns with Timely ITR Filing for FY 23-24”

“Deadline Dilemma: How to File Your ITR for FY 23-24 Like a Pro!”